What is Gross Development Value (GDV) in Property Development?

What is Gross Development Value (GDV)?

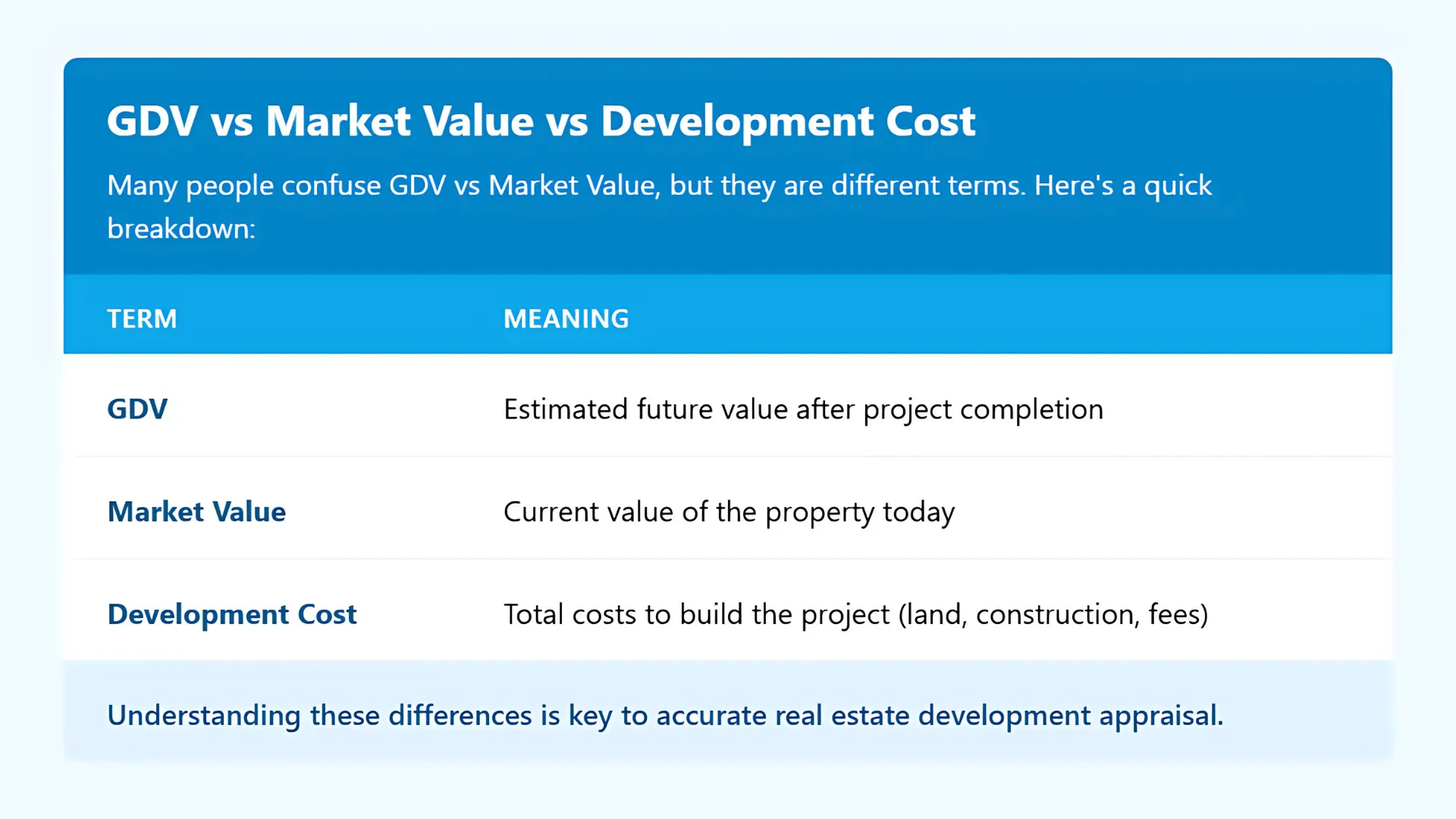

Gross Development Value (GDV) is the estimated total value of a property or development project after it’s completed and ready to sell or rent.

It includes all the revenue that could be earned from the development — for example, the sale price of flats, rental income, or revenue from retail or parking space. In other words, it shows what the project will be worth in the market once everything is done.

Why Understanding Gross Development Value (GDV) Matters

When starting a real estate development project, one of the most important things to understand is Gross Development Value (GDV). Whether you’re building a new apartment block or renovating a house to sell, GDV helps you estimate how much the property will be worth once the work is finished.

This figure plays a big role in making smart investment decisions, getting loans, and calculating profits. In this blog, we break down GDV in property development in simple terms to help beginners and investors understand how it works and how to use it.

Why is GDV Important for Property Developers?

Understanding GDV helps developers in many ways:

- It helps forecast property development profits before the project begins.

- GDV is essential when applying for funding from banks or investors.

- It tells you whether the project is worth doing based on potential returns.

- It’s a key part of any real estate development appraisal.

By estimating GDV early, you can avoid taking on risky projects that won’t bring enough return on investment.

How to Calculate GDV (Step-by-Step)

Knowing how to calculate GDV accurately can make or break your development. Here’s a simple step-by-step guide:

- Know the Units – Count the number of flats, houses, or commercial spaces you’ll build or renovate.

- Check Market Values – Research current selling prices or rents in that area.

- Multiply – Units × Market Value = Gross Sales Value.

- Add Extra Income – Include other sources like car parks, retail units, or storage.

- Adjust for Risk – Factor in local demand, economic trends, and potential delays.

💡 Basic GDV Formula:

GDV = (Number of Units × Market Value) + Other Income

Example: Simple GDV Calculation

Imagine you’re building 10 flats in a U.S. city where each flat could sell for $250,000.

10 × $250,000 = $2.5 million

You also expect $100,000 from a small retail unit on the ground floor.

Final Gross Development Value (GDV) = $2.6 million

This figure helps you compare the GDV to your total development costs and decide if the project is profitable.

Common Mistakes When Estimating GDV

Even experienced developers can make mistakes when estimating GDV. Some common ones include:

- Overestimating market prices – Always use real, local data.

- Ignoring hidden costs – Like legal fees or planning delays.

- Forgetting about other income – Like rentals, which affect your property development profits.

- Not adjusting for risk – Markets can change fast, especially during long projects.

Conclusion

To succeed in property development, you must know your numbers. Gross Development Value (GDV) gives you a clear view of what your project could be worth. When used properly, it can help you plan smarter, attract funding, and increase your property development profits.

Always use accurate market data, consider all revenue sources, and don’t skip the risk assessment. That way, your GDV estimate will guide your project to success.